The wholesale energy market is where electricity is bought and sold in bulk before reaching the retail market. Understanding the wholesale electricity market is essential for anyone in the electricity industry. These markets set electricity prices that affect energy costs for all consumers. They also keep the electricity grid stable.

What Is a Wholesale Energy Market?

A wholesale power market allows traders to buy and sell large amounts of electricity. Generators sell electricity to suppliers, who then sell it to consumers. The wholesale market lets participants buy and sell electricity 24/7.

Prices change with supply and demand. They also change with energy sources. Weather can affect renewable energy output. Grid limits can also affect prices.

They designed the electricity market this way because large-scale power storage costs too much. We must use electricity when we generate it. This requires constant real-time balancing across the grid.

How Do Wholesale Electricity Markets Work?

The system operator runs markets where generators offer to sell electricity for delivery.

Buyers also place bids to buy and sell energy products. The market sets the clearing price where electricity supply equals demand.

The marginal price comes from the most expensive generator needed to meet demand. This transparent price mechanism provides essential price signals guiding investment across the energy system.

Types of Wholesale Energy Markets

Understanding wholesale electricity markets include knowing different platforms where electricity can be traded. Day-ahead and intraday markets work together sequentially, while balancing and capacity markets serve distinct functions.

Day-Ahead Market: The primary power market where most wholesale trading occurs. Market participants buy or sell electricity for delivery the next day, handling 80-90% of wholesale power volumes. This market allows generators to plan how they’ll generate electricity and secure fuel from energy sources.

Intraday Market: The intraday continuous market enables participants to trade electricity closer to real-time as market conditions change. This market runs all the time, like a stock exchange. Buy and sell orders match right away. This is important for independent renewable energy producers facing forecast uncertainty.

Balancing Markets: These markets operate during actual delivery when the system operator corrects imbalances between electricity generation and consumption. Wholesale electricity prices can be very volatile. They can reach thousands per MWh when the grid struggles to meet demand.

Capacity Market: Unlike energy markets that pay for electricity delivered, capacity markets pay generators to keep plants available. This helps meet future peak demand. This market design ensures the electricity supply remains adequate across the national energy system.

Key Market Participants in the Wholesale Electricity Market

Generators and Power Plants: Market participants owning facilities that generate electricity from various energy sources. Baseload power plants run continuously with low costs, while peaking plants have higher energy costs but quick start-up. Independent renewable energy producers operate wind and solar with near-zero marginal costs but variable output.

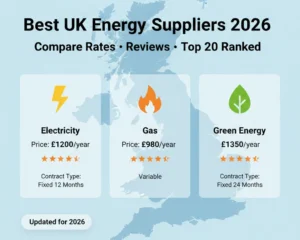

Energy Suppliers and Retailers: These participants buy wholesale electricity and sell it to consumers in the retail market. They manage changing wholesale electricity prices using hedging strategies. The retail market shields consumers from extreme price volatility in wholesale trading.

Energy Traders: Professional traders buy or sell electricity to profit from price differences in commodity markets, providing essential liquidity. Energy traders help incorporate information into market signals without owning power plants.

System Operator: Manages the electricity grid and administers wholesale electricity markets. The system operator monitors the GB electricity market in Britain, or regional markets. It works with energy regulators to keep the electricity system stable.

How Are Wholesale Electricity Prices Determined?

The wholesale price depends on the marginal cost of the priciest generator needed to meet electricity demand. This electricity market design uses “merit order” dispatch.

Nuclear and renewables cost about €0–10/MWh. Coal costs about €30–60/MWh. Combined-cycle gas costs about €50–100/MWh. It often sets the market clearing price.

Expensive peakers cost about €100–300+/MWh. They provide electricity during peak demand.

Wholesale electricity prices swing wildly because people cannot store electricity economically, so supply and demand must balance instantaneously. The electricity needs of consumers are price-inelastic short-term.

A 2% supply shortfall can cause price spikes above €1,000/MWh. This creates risks and opportunities. Flexible assets can earn high profits during scarcity.

Wholesale vs. Retail Energy Markets

The wholesale market trades bulk electricity between generators and intermediaries, while the retail electricity market sells power to consumers. Understanding the wholesale energy system explains why electricity bills don’t immediately reflect wholesale market changes.

The wholesale power market involves megawatt-hours with extreme price volatility where market participants buy electricity from generators. The retail market involves kilowatt-hours with stable prices where consumers purchase electricity through fixed contracts. Retail energy suppliers bridge these markets, absorbing short-term volatility.

Your retail electricity bill has four parts. Energy (30–40%) depends on wholesale prices and other energy costs. Network charges (30–40%) pay for the electricity grid. Taxes (20–30%) support clean energy programs.

Supplier margin (5–10%) covers the supplier’s profit and costs. This explains why lower energy prices in wholesale markets take time to flow through to retail rates.

How Renewable Energy Impacts Wholesale Electricity Markets

Clean energy is changing how wholesale electricity markets work. It adds large amounts of electricity from wind and solar. This power costs almost nothing to produce.

When independent renewable energy producers make electricity, their low costs push fossil fuel generators out. This lowers the electricity price, sometimes to zero or even negative.

On sunny, windy days with low demand for electricity, renewable energy might provide 60% of generation. Wholesale electricity prices fall to €0-5/MWh, and some power plants even pay to produce electricity rather than shut down.

Market Challenges: Forecasting uncertainty requires independent renewable energy producers to actively trade in day-ahead and intraday markets. Reduced market signals when renewable energy frequently sets near-zero prices make investment decisions harder. The energy system needs increased flexibility from storage, demand response, and flexible generation.

Market Adaptations: Progressive electricity markets use shorter trading intervals, apply locational pricing that reflects where generators produce electricity, and run separate flexibility markets. The European energy sector and cooperation of energy regulators are pioneering new market designs. For more details, see the International Energy Agency’s renewable energy market reports.

What Are Flexibility Markets?

Flexibility markets are new markets compensating market participants for rapid adjustments helping balance the electricity grid. These markets involve services separate from traditional energy products, critical as renewable energy grows and the electricity system needs dynamic resources.

Services include frequency response, which makes automatic changes within seconds. They also include reserve capacity, where plants start within minutes during emergencies. Other services are voltage support and congestion management.

As clean energy replaces thermal plants, the wholesale market needs new flexibility sources. Battery storage, demand response, and hybrid energy systems can deliver energy products and grid services. Hybrid systems combine renewables with storage.

Markets Operate in the Clean Energy Transition

The clean energy transition reshapes how the wholesale electricity market works. Variable renewables, distributed energy resources, and electrification challenge the electricity market design optimized for thermal generation.

Solar and wind energy sources have near-zero fuel costs, driving down wholesale power prices but creating revenue challenges. Weather-dependent generation from independent renewable energy producers requires more system flexibility than predictable thermal power plants. Rooftop solar and batteries change how electricity uses patterns appear to the system operator.

Markets are adopting nodal pricing that reflects where electricity is made and used. They use shorter settlement periods, like 5 minutes instead of hourly.

They co-optimize energy products and services. They also let hybrid energy systems buy or sell power across many platforms. The U.S. Energy Information Administration provides analysis of how understanding wholesale market evolution affects the electricity industry.

Global Wholesale Electricity Markets

Wholesale electricity markets operate differently across regions, affecting how market participants trade electricity and how the electricity industry functions.

North America: Multiple markets (PJM, CAISO, ERCOT) with sophisticated nodal pricing and 5-minute settlements. ERCOT runs an energy-only market with high price caps. It has electrical isolation, so it cannot buy power from nearby grids during emergencies.

Europe: Pan-European integration through Nord Pool, EPEX SPOT enables cross-border wholesale trading. The European energy market features cooperation of energy regulators across countries. The GB electricity market operates with its own balancing mechanism.

Australia: The NEM uses 5-minute dispatch intervals, among the shortest in large power systems.

It is energy-only, and wholesale prices can reach very high caps during scarcity.

Market Manipulation and Regulation

Market manipulation in the wholesale electricity market involves intentionally distorting prices or supply for profit, undermining how the market works. Common strategies include physical withholding, like keeping power plants offline during high demand. They also include economic withholding, like bidding to sell electricity at very high prices. Another strategy is cross-market manipulation.

Physical capacity constrains the electricity supply, and utilities cannot store electricity economically, which makes markets vulnerable. The cooperation of energy regulators monitors wholesale electricity markets through automated surveillance, investigating suspicious patterns. Penalties can reach billions of euros with financial fines and trading bans.

Entry Requirements for New Participants

Entering the wholesale power market requires significant preparation. What you need to know about wholesale electricity trading: the market needs participants with substantial resources and expertise.

Requirements include licenses from the system operator to trade electricity. You also need technical platforms to buy and sell electricity. You need forecasting systems to estimate how much electricity is needed. Experienced personnel must understand how the markets work. Significant capital is needed to manage imbalance risk.

New entrants often begin with power purchase agreements that sell electricity for delivery at fixed prices, avoiding volatile exposure. Alternatively, they work with aggregators managing wholesale trading complexity. Understanding wholesale energy markets takes time. Successful participants develop expertise gradually.

Frequently Asked Questions

Why do wholesale electricity prices sometimes go negative?

Negative prices occur when the electricity supply significantly exceeds demand for electricity and generators are willing to pay to continue operating rather than shut down power plants. This happens during periods of high renewable energy output combined with low electricity needs.

Generators accept negative prices because nuclear plants face high restart costs, while wind and solar receive subsidies making negative wholesale prices profitable overall. Negative market signals indicate oversupply and should encourage storage to buy electricity for later use.

How does weather affect the wholesale energy market?

Weather impacts both sides of supply and demand. Temperature extremes drive consumption as people use electricity for heating or cooling.

On the supply side, renewable energy output varies with the weather. Wind speeds affect turbines, sunshine affects solar panels, and rainfall affects hydroelectric generation. Power plants also experience efficiency changes in extreme heat. Weather forecasts are critical for market participants trying to determine the amount of electricity they’ll generate or need to buy electricity to meet demand.

What happens during an electricity supply shortage?

During shortages when available generation cannot provide electricity to meet demand, wholesale electricity prices spike dramatically to market price caps (€3,000-9,000/MWh or higher). The system operator activates all reserves, issues appeals for voluntary consumption reduction, and ultimately implements rotating blackouts if the electricity system cannot maintain balance. These extreme price signals encourage every possible increase in supply. They reward those who kept capacity ready for these rare events.

How do wholesale and retail energy markets differ?

The wholesale market involves large-scale trade electricity between generators and suppliers at volatile prices that change continuously. The retail electricity market sells to consumers at stable prices through fixed contracts. Retail suppliers buy electricity at wholesale prices and sell electricity to consumers, absorbing short-term volatility. Your retail bill includes energy costs, plus network charges for the electricity grid. It also includes taxes that support clean energy and supplier margins.

Final Takeaways

Understanding wholesale electricity markets is essential for anyone involved in the electricity industry or interested in how clean energy transforms our energy system. These markets coordinate hundreds of generators and consumers in real-time through sophisticated day-ahead markets, intraday continuous markets, balancing mechanisms, and capacity markets.

The wholesale market supports efficient price discovery through marginal pricing.

In this system, the most expensive generator needed sets the clearing price for everyone. This electricity market design ensures economic efficiency while providing transparent price signals that guide investment in new power plants and energy resources.

The clean energy transition is reshaping how wholesale electricity markets operate. Variable renewable energy from independent renewable energy producers, distributed generation, storage, and electrification challenge designs built for dispatchable thermal generation. Markets are adapting through enhanced flexibility markets, granular locational pricing reflecting where electricity is generated, and reformed scarcity mechanisms.

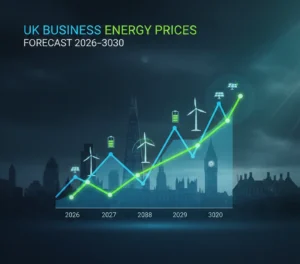

Success in wholesale power markets requires deep technical expertise, sophisticated risk management when you buy or sell electricity, substantial capital resources, and continuous adaptation to market conditions. The wholesale energy sector operating in 2030 and beyond will look significantly different from today, placing greater emphasis on flexibility services, hybrid energy systems, and integration of distributed energy resources.

Whether you’re a generator selling electricity for delivery, a retailer managing the purchase and sale of energy products, or an investor analyzing the electricity industry, understanding how the wholesale electricity market works is crucial. These markets literally power modern civilization, their efficient operation affects every aspect of economic activity and our transition to clean energy.