Guides and blogs

Energy Solutions guides and blogs offer a go-to resource for clear, practical advice on managing business energy more efficiently. Whether you’re reviewing your current contract or trying to cut long-term costs, our expert-written guides are here to give you clear, practical support.

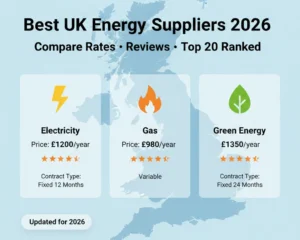

Managing business energy can be time-consuming, especially with ever-changing tariffs, regulations, and sustainability targets. That’s why we’ve built a dedicated library of resources tailored to the challenges businesses face every day. From choosing the right supplier and understanding contract types to improving efficiency and going green, our guides cover it all.

- Get a quote in minutes

- Compare top UK suppliers

- Best price guarantee

Energy & Utility Guides

At Energy Solutions, we’re more than an energy broker – we’re a long-term partner helping businesses reduce costs, minimise their carbon footprint, and meet their sustainability goals. Our advice is independent, up to date, and always focused on what’s best for your organisation.

Whether you’re a large enterprise or a growing start-up, we believe you deserve the tools to take control of your energy strategy. These guides are built to save you time, simplify your decisions, and deliver better results – both financially and environmentally.

Guides and blogs

Energy Solutions guides and blogs offer a go-to resource for clear, practical advice on managing business energy more efficiently. Whether you’re reviewing your current contract or trying to cut long-term costs, our expert-written guides are here to give you clear, practical support.

Managing business energy can be time-consuming, especially with ever-changing tariffs, regulations, and sustainability targets. That’s why we’ve built a dedicated library of resources tailored to the challenges businesses face every day. From choosing the right supplier and understanding contract types to improving efficiency and going green, our guides cover it all.